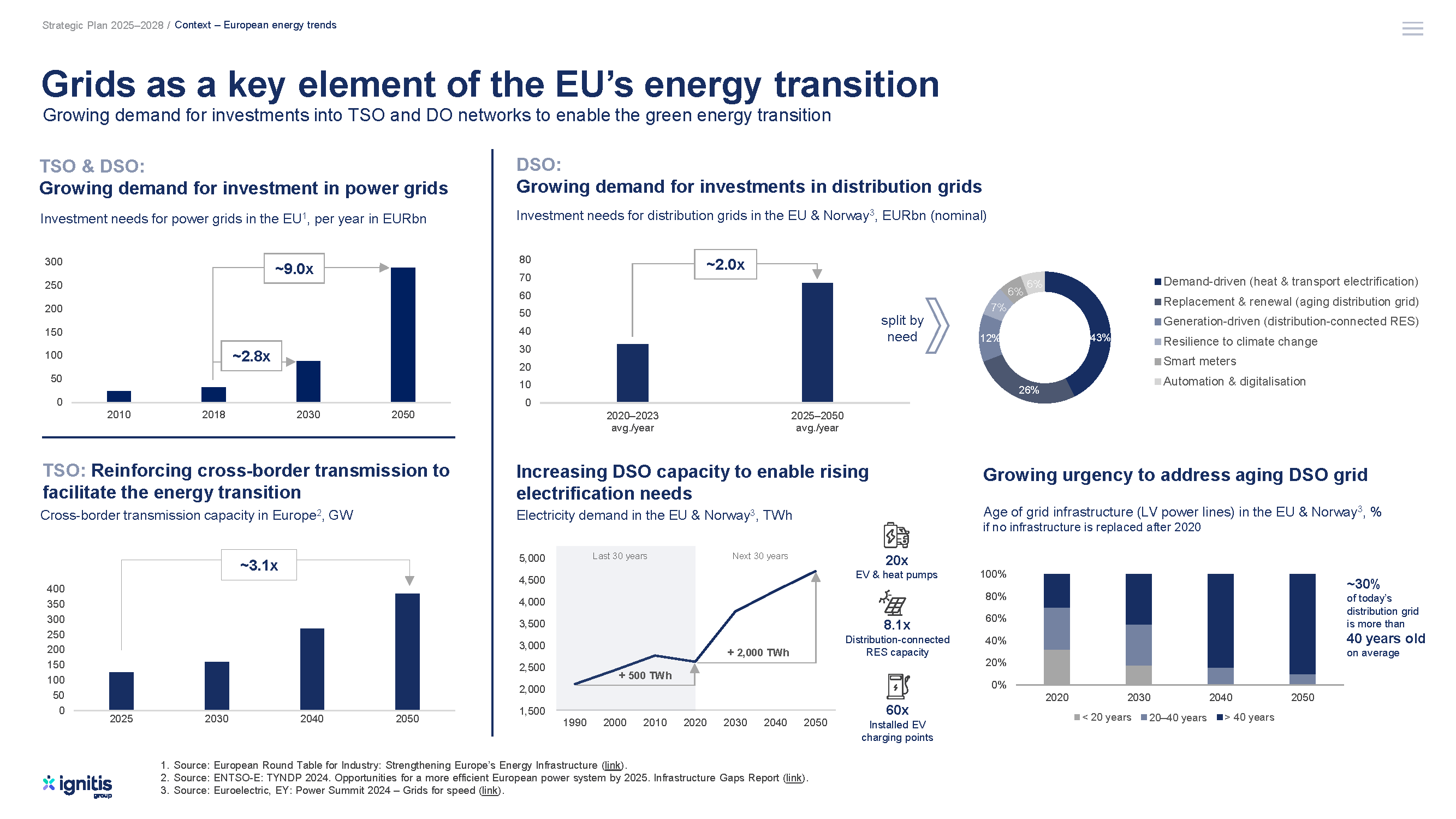

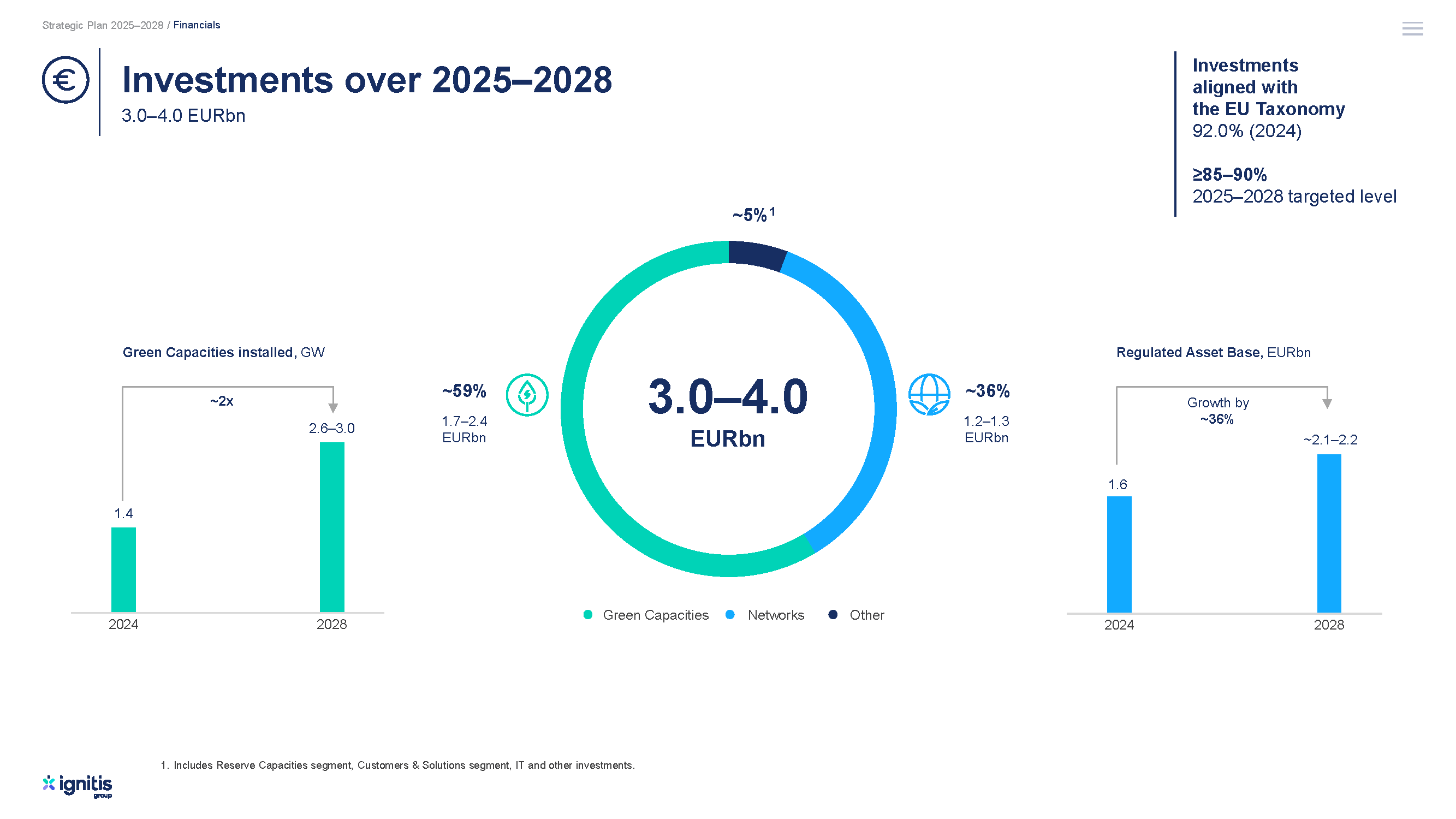

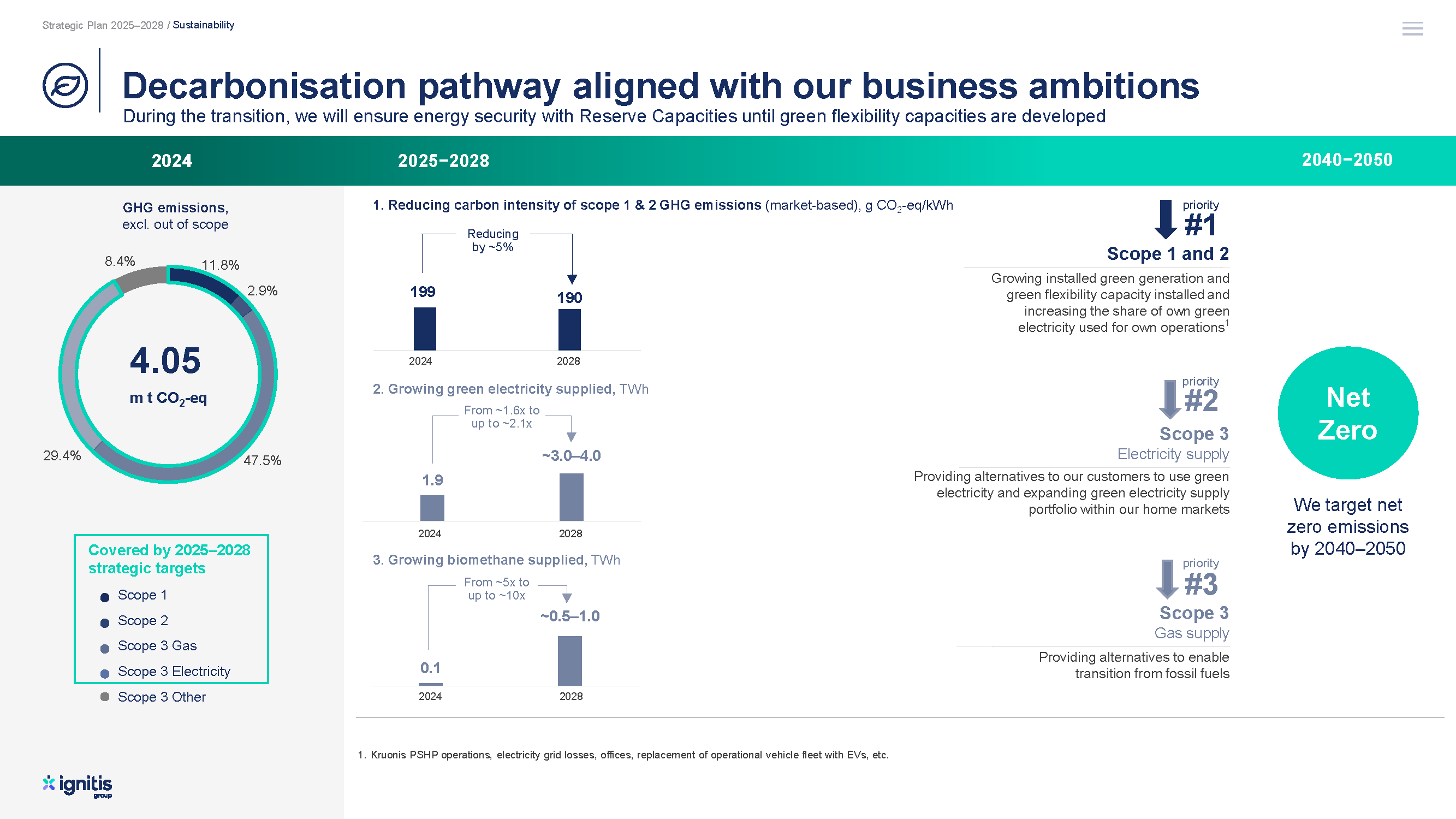

To deliver on our strategy, we plan to invest EUR 3.0–4.0 billion over the 2025–2028 period with over 85–90% of the investments to be aligned with the EU Taxonomy.

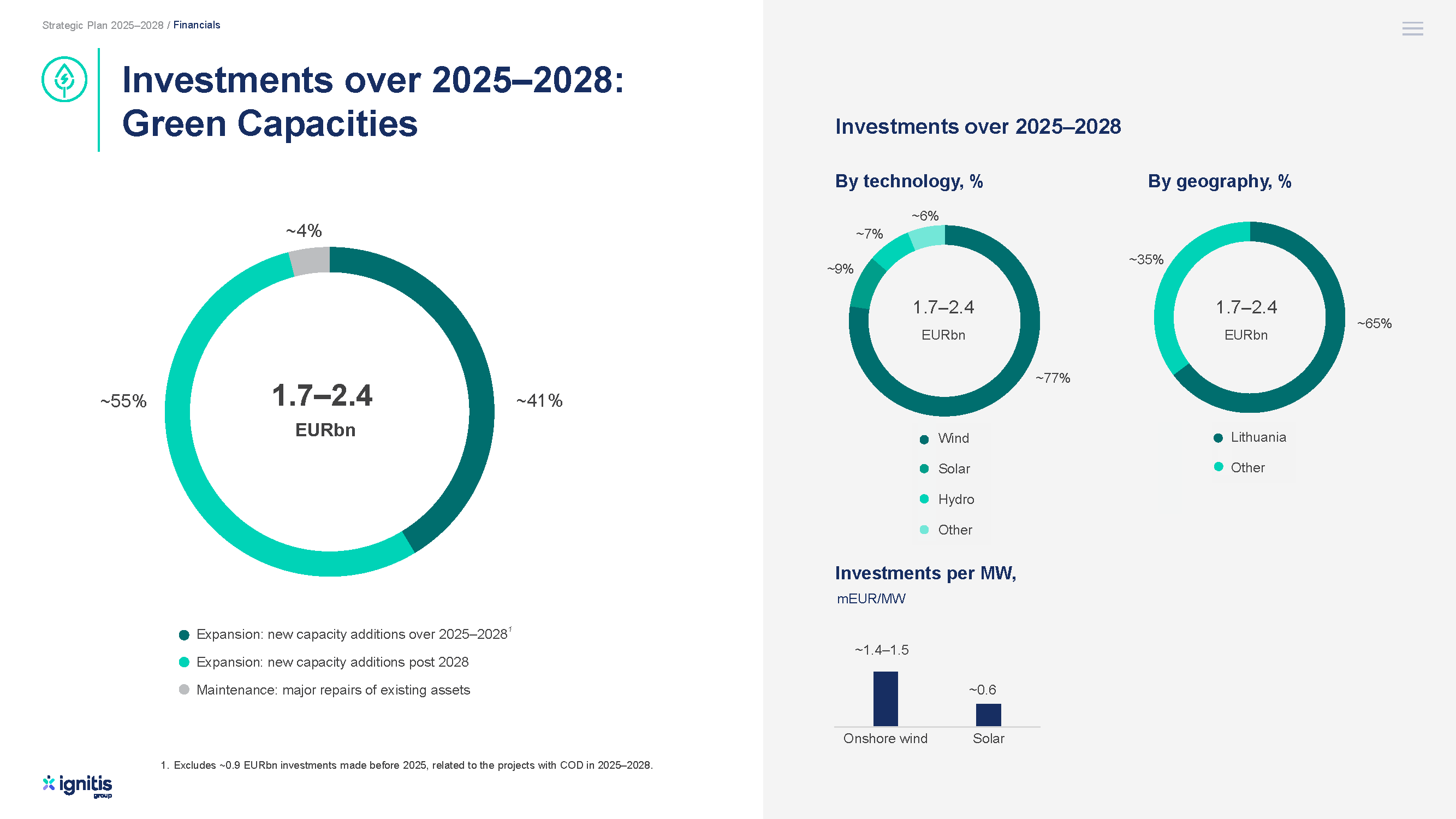

We plan to direct EUR 1.7–2.4 billion (around 59% of the Investments) to further develop green generation and green flexibility technologies. We target to double the installed Green Capacities, reaching a total of 2.6–3.0 GW in 2028 compared to 1.4 GW in 2024. More than half of the Green Capacities Investments over the 2025–2028 period relate to new Installed Green Capacities additions after 2028.

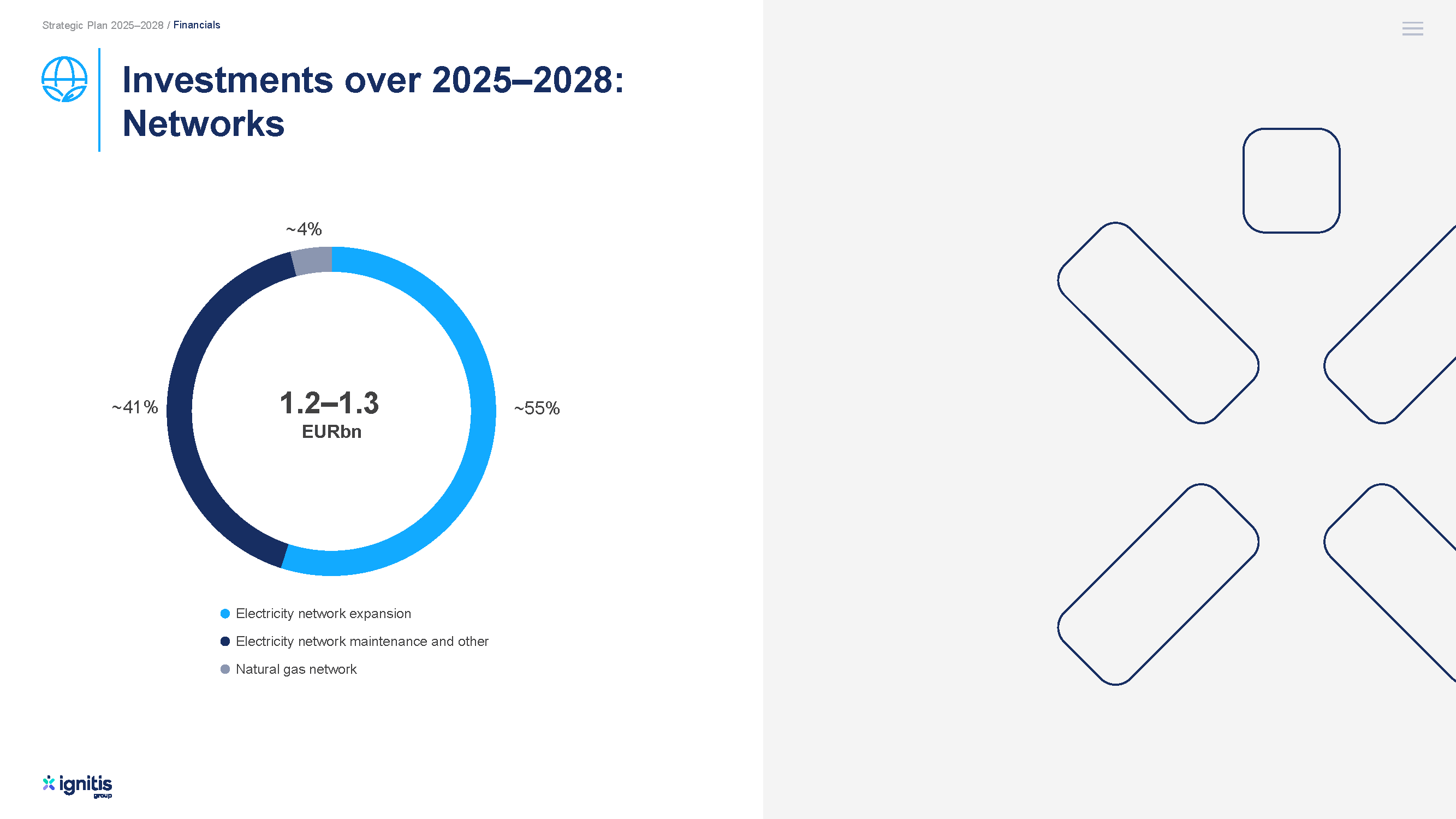

We are planning to direct EUR 1.2–1.3 billion or around one third of our Investments towards the expansion of a resilient and efficient electricity distribution network, which is one of key elements of a successful energy transition.

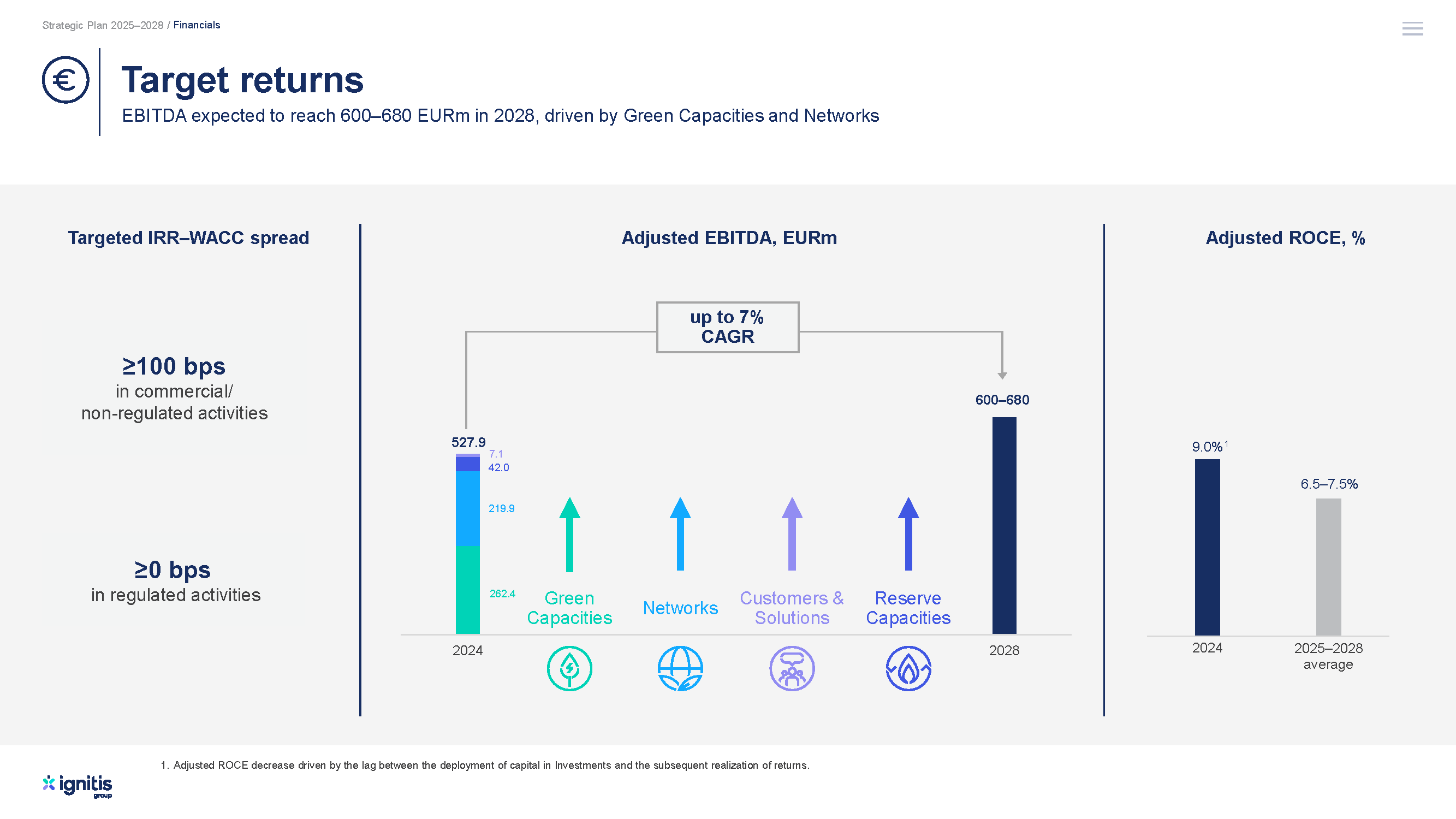

We are expecting the Group’s Adjusted EBITDA in 2028 to be within the range of EUR 600–680 million compared to EUR 527.9 million in 2024. The average Adjusted ROCE is projected to reach 6.5–7.5% in 2025–2028.

We expect to maintain our credit rating of ‘BBB’ and above over the 2025–2028 period. We will continue our investment programme while maintaining net debt to EBITDA below 5 times.

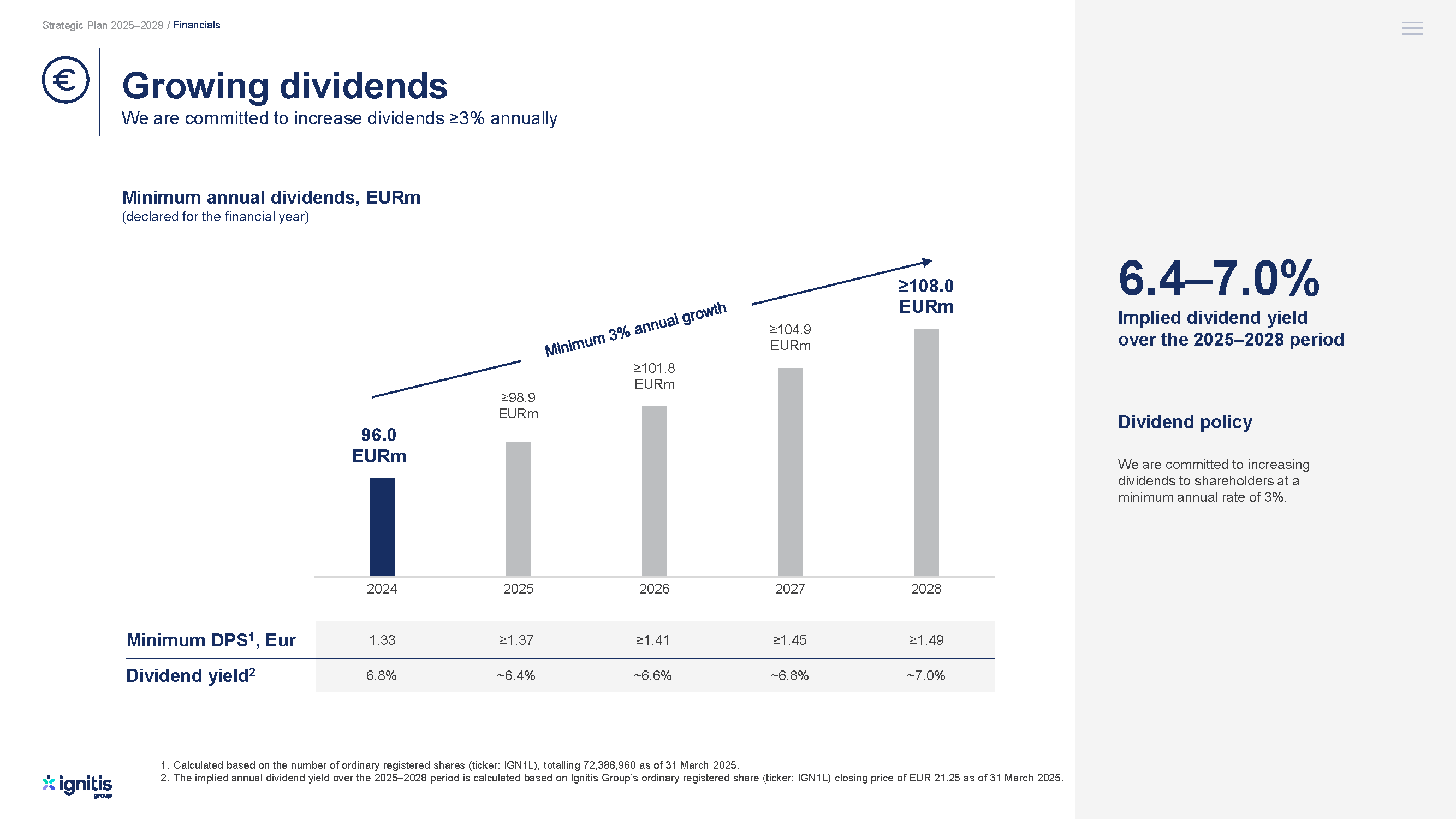

We are committed to a at least 3% annual dividend growth, representing a 6.4–7.0% implied dividend yield in the 2025–2028 period.